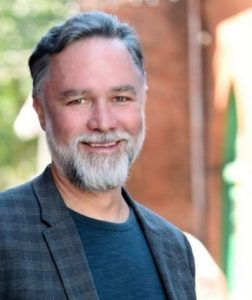

Since 1999 Jason has been investing in real estate and comes from a family of real estate agents and brokers. He is a partner in a house flipping business to generate capital. His focus is on multi-family real estate. He believes it is the best asset class to invest in because it provides monthly income, opportunities for forced appreciation, economies of scale, and reduced risk. He has teamed up with other professionals in the business who own thousands of doors. We are in the process of finding deals and providing opportunities to others to passively invest in real estate. Subscribe to learn how to invest in real estate assets without the headaches of managing rental properties yourself and enjoy the passive income. The stock market is unstable, real estate moves slow and is much more stable.

Since 1999 Jason has been investing in real estate and comes from a family of real estate agents and brokers. He is a partner in a house flipping business to generate capital. His focus is on multi-family real estate. He believes it is the best asset class to invest in because it provides monthly income, opportunities for forced appreciation, economies of scale, and reduced risk. He has teamed up with other professionals in the business who own thousands of doors. We are in the process of finding deals and providing opportunities to others to passively invest in real estate. Subscribe to learn how to invest in real estate assets without the headaches of managing rental properties yourself and enjoy the passive income. The stock market is unstable, real estate moves slow and is much more stable.

Mikk has an MBA in Finance and has been investing in real estate since 2004. His working career started at KPMG – a big 5 accounting firm – where he worked in the business valuation department. From there he progressed into the mortgage brokerage business where he garnered significant real estate-financing experience. By 2004 however, he discovered his passion was in real estate investing and since then he has never looked back. Over the last 16 years Mikk has been involved in various types of real estate investing ranging from pre-foreclosures, tax sales, commercial property, wholesaling, mortgage note investing, and most importantly multi-family. Though he has had the opportunity to use various property management companies over the years, Mikk has stayed committed to managing his own rental portfolio which gives him a 1st hand account of exactly how best to manage a rental asset. He currently manages over 25 units personally.

Read MoreWe look for properties that are of high-quality and can be improved to increase the Net Operating Income (NOI) for our investors.

When analyzing deals we use a conservative approach to the underwriting process to make sure the deal is purchased for the right price and there are cash reserves for unforeseen issues.

We partner with teams with experience taking down hundreds of doors. They have been doing this business for many years.

Communication with passive investors is something we take very seriously. Transparency about the plan going into a project and any plan changes as they arise during the course of the deal is very important to us and our investors.

Email us directly for more information.